A Landmark Tax Bill Sparks National Debate

President Trump’s recently passed “One Big Beautiful Bill Act” is being called the most sweeping tax bill of its kind ever signed. Passed narrowly in the House, the legislation brings major tax cuts and trims social safety net programs, with all Democrats opposing and almost all Republicans in favor. Trump hailed it as a rocket-boost for the country, but economists and critics argue it will mostly benefit the wealthy while worsening the situation for lower-income Americans.

Impact on States with High Property Taxes

A central feature of the bill is the sharp increase in the state and local tax (SALT) deduction cap—from $10,000 to $40,000. This provision is set to benefit homeowners, especially in high-tax states like New Jersey, New York, Connecticut, Massachusetts, California, and Illinois. In these areas, many residents pay substantial property taxes and will now see thousands in tax savings. However, the new cap primarily helps higher-income buyers and investors, while average buyers in these states could face even higher home prices due to increased demand.

A Boom for Investors—And New Real Estate Dynamics

Real estate professionals and investors are calling the bill a win. It brings back 100% bonus depreciation, allowing the full cost of certain property improvements to be deducted right away—an attractive perk for developers and landlords. Business income deductions are expanded, and production-related facility investors could also see new tax advantages. These changes are expected to spur renovation, development, and new investments in already expensive markets, further fueling competition in states and metros where property taxes and home prices are high.

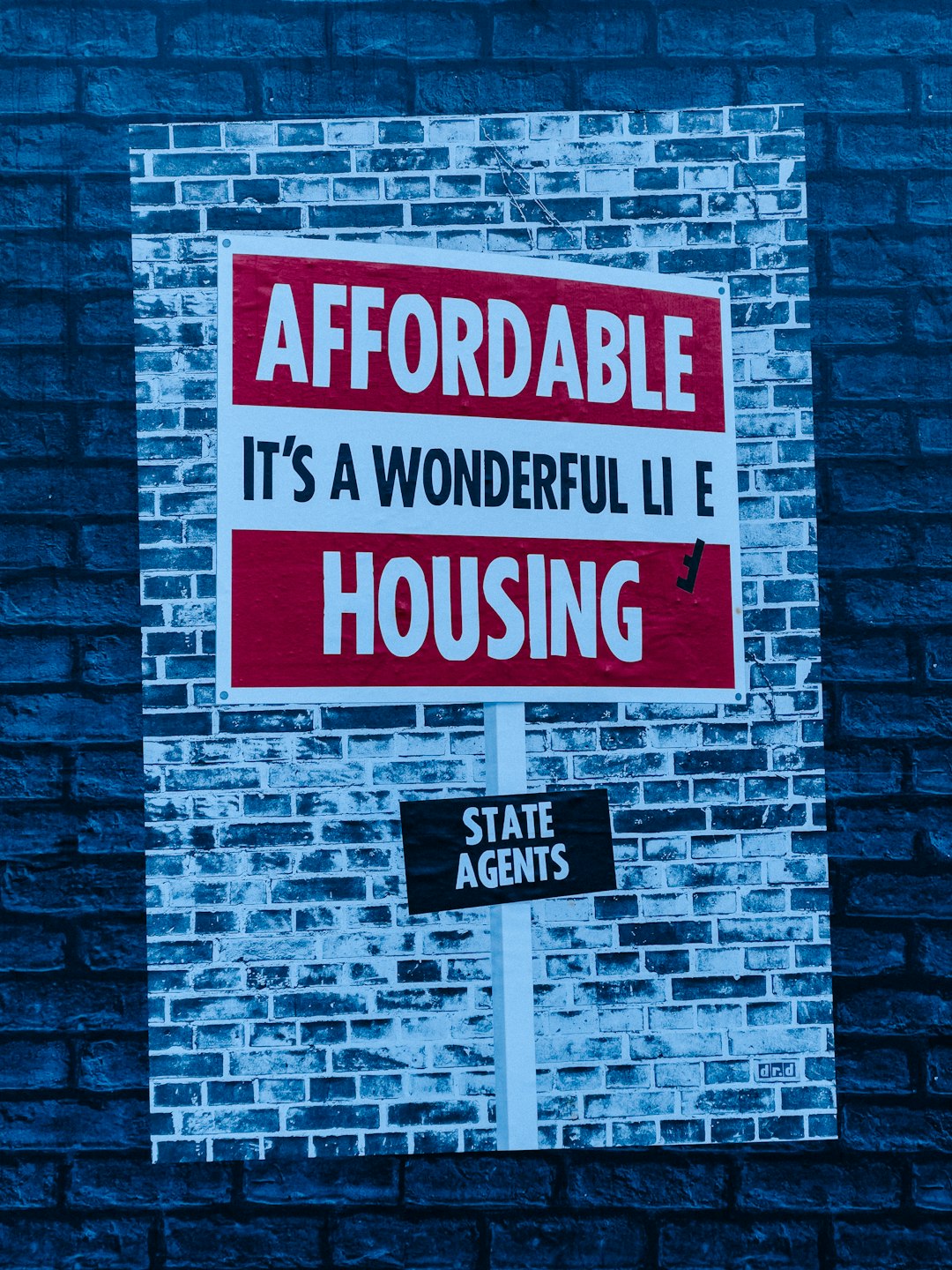

Low-Income Households and the Housing Shortage

Despite a few measures to support affordable housing—like expanding the Low-Income Housing Tax Credit and adjusting opportunity zone incentives—experts warn these efforts won’t quickly ease housing pressures in high-cost states or cities. Several credits for energy-efficient homes and improvements are terminated by the bill, a move that analysts say could increase new home prices and slow down much-needed construction. These changes come on top of earlier tariffs that raised the cost of building materials, putting additional strain on both supply and affordability.

A Divided Outlook for States and Everyday Americans

While real estate professionals and high-income buyers in select states stand to gain, everyday Americans—especially renters and first-time buyers—are likely to see little benefit and perhaps even face new challenges. With housing costs already elevated and affordable housing in short supply, the bill’s long-term effects will likely be felt differently across states, deepening existing regional and economic divides in America’s housing market.

Matthias is a skilled author and digital storyteller with a focus on travel journalism, environmental issues, and modern home design. With a background in communications and a passion for global cultures, Matthias crafts engaging narratives that blend real-world exploration with thoughtful analysis and visual flair.

His writing reflects a deep interest in how climate change shapes our lives and lifestyles—from sustainable travel practices to eco-friendly living environments. Known for his clear, approachable voice and sharp editorial instincts, Matthias delivers content that resonates with readers seeking both inspiration and substance.

Whether reporting from remote destinations, breaking down sustainable design trends, or spotlighting innovative green initiatives, Matthias brings a global perspective and an eye for detail to every piece. He regularly contributes to web platforms and editorial projects that aim to foster awareness, creativity, and conscious living.